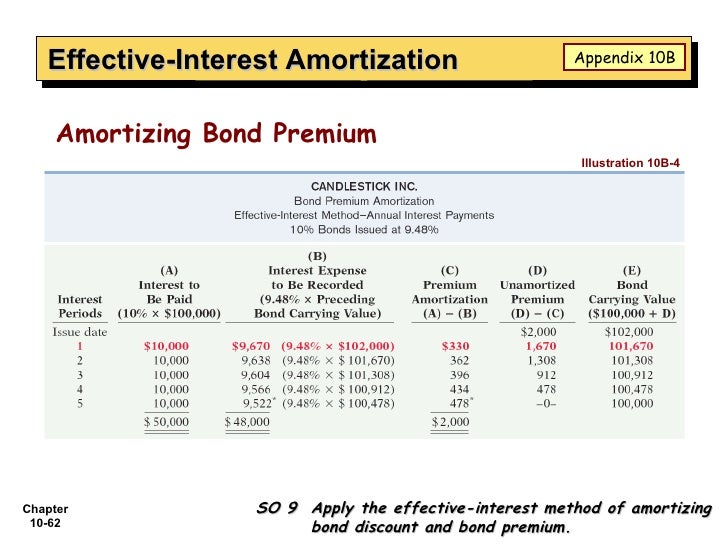

However, as the carrying value of the bond increases or decreases, the actual percentage interest rate correspondingly decreases or increases.įor example, Valenzuela bonds issued at a discount had a carrying value of $92,976 at the date of their issue. It makes an unrealistic assumption: namely, that the interest cost for each period is the same, even though the liability's carrying value is changing.įor example, under this method, each period's dollar interest expense is the same. Effective Interest Method: ExplanationĪlthough the straight-line method is simple to use, it does not produce the accurate amortization of the discount or premium. When you use the effective interest method, the carrying value of the bonds is always equal to the present value of the future cash outflow at each amortization date. Therefore, the interest rate is constant over the term of the bond, but the actual interest expense changes as the carrying value of the bond changes.

Under the effective interest method, a constant interest rate-equal to the market rate at the time of issue-is used to calculate the periodic interest expense. What Is the Effective Interest Method of Amortization?

0 kommentar(er)

0 kommentar(er)